The all out worth of homes in the US hit a record-breaking $47 trillion in June 2023. We investigate what's driving America's home value development and which markets are posting the biggest additions.

The U.S. real estate market has as of late arrived at a memorable achievement, as the complete worth of all US land hit an unequaled high of $47 trillion in June 2023. An examination from the Redfin Gauge of north of 90 million US private properties has offered a few fascinating bits of knowledge into this expanded interest. In any case, what's driving the upswing in values?

Surging Prices Despite Sluggish Demand

Strangely, the record-breaking numbers come in the midst of a period set apart by tepid interest. The explanation? A critical deficiency of homes available. With less property holders choosing to sell, supply has battled to satisfy need. This has continued to house estimations set up.

One element behind property holders' hesitance to sell is the alluring 3% home loan rate many secured during the pandemic. As far as they might be concerned, selling and moving would mean taking on a home loan rate that is almost twofold the rate they as of now appreciate. While this likewise influences request from expected buyers, the absence of stock is offsetting the easing back of interest.

Winners and Losers in Today’s Market

As per Redfin Financial matters Exploration Lead, Chen Zhao, the ongoing lodging situation in the US is a distinct outline of "champs and washouts". The champs are the people who made their buys before the ascent in contract rates, ceaselessly developing value. Then again, first-time purchasers end up wrestling with high getting costs, out of this world home costs, and a serious market with not many houses.

West Coast and Pandemic Boomtowns See Declines

West Coast tech centers and beforehand famous pandemic objections saw the absolute most huge decreases in home estimations. Areas like Austin, Seattle, San Francisco, and Los Angeles experienced drops going from 6.6% to 9.6% year over year.

These decays can be credited to a mixed drink of elements, from expensive business sectors having more space for esteem drops to telecommuters leaving to additional reasonable regions, and tech industry cutbacks.

Affordable Markets Shine

Then again, more reasonable business sectors like Little Stone and Milwaukee have seen surprising additions in home estimation. A large number of these business sectors haven't encountered the overheating seen in urban communities like Phoenix or San Francisco.

This has permitted space for values to climb. Homes in these business sectors ordinarily sell for sums underneath the public middle of $426,056, making them appealing to likely purchasers.

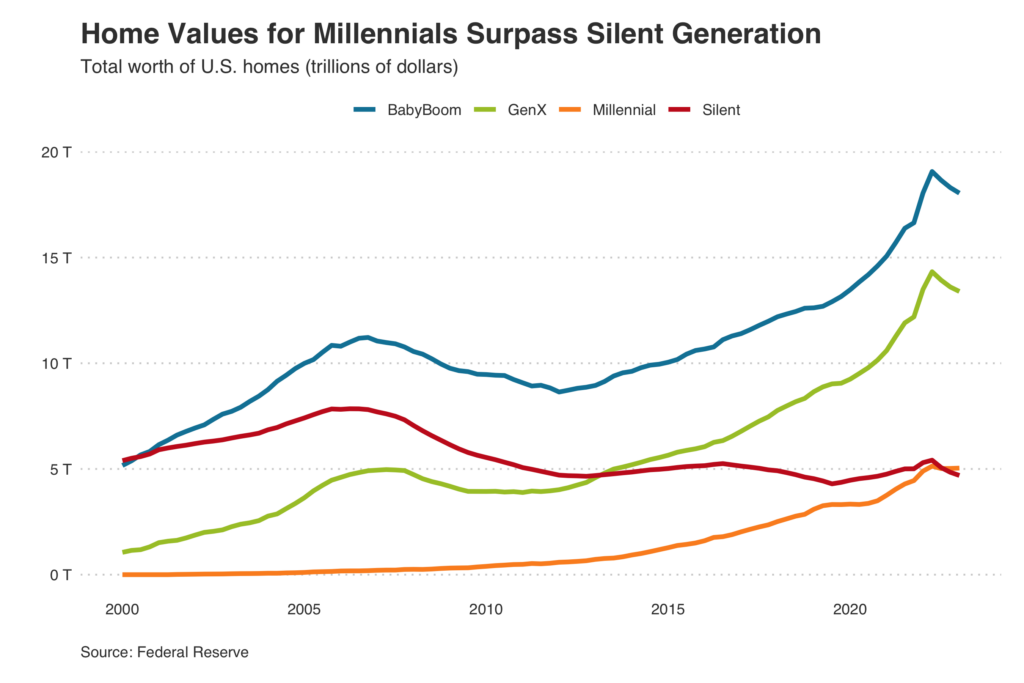

Millennials Hold More Home Value

The all out worth of all US land claimed by Recent college grads developed by 2.9% year on year to the principal quarter of 2023. They currently outperform "the quiet age" (those brought into the world from the 1920s - 1940's) with regards to home estimation.

This is ascribed to the way that recent college grads are currently of prime home-purchasing age, and make up around 60% of buys purchased with contracts lately.

Luxury vs. Mid Range

The all out worth of all US land is on the ascent, yet not all properties are appreciating. While extravagance homes are confronting a plunge in esteem, homes valued somewhere in the range of $250,000 and $750,000 are seeing significant increases.

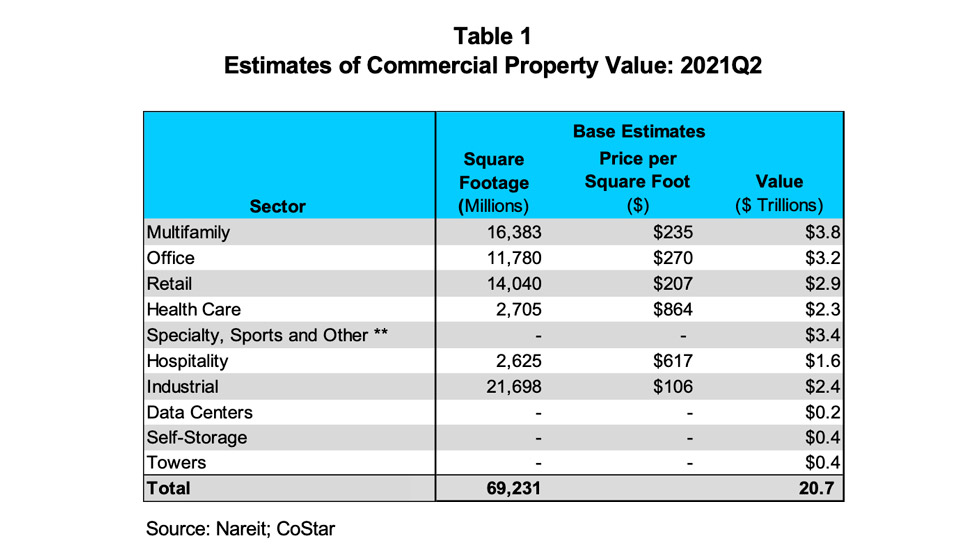

Related Post: Publicly Traded Firms Now Own $1.64t of Us Real Estate

The complete worth of homes somewhere in the range of $500,000 and $750,000 shows an increment of 4.1% year on year and 4% for those somewhere in the range of $250,000 and $500,000. Conversely, homes esteemed between $2 million and $5 million saw a 7.4% lessening in esteem, while those in the $1 million to $2 million territory confronted a 2.6% decrease.

The elements of the ongoing U.S. real estate market set apart by a back-and-forth between request, supply, and outside financial elements make for an intriguing perusing. Property holders are clutching their low home loan rates and first-time purchasers are confronting different impediments, making the direction of the market hard to anticipate. Be that as it may, the U.S. real estate market will probably begin to reset once contract loan fees ease.

Read Also : Are SWV and Xscape touring together? Tove Svendson

Tove Svendson

No comments