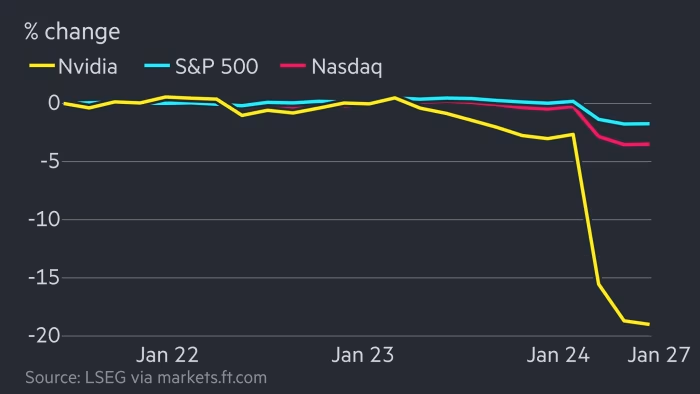

Stock markets were being rocked Monday by a flurry over an AI chatbot created by the Chinese tech firm DeepSeek, which was also igniting discussions about the geopolitical and economic rivalry between China and the United States in the development of AI technology.

Driven by interest in the ChatGPT rival, DeepSeek's AI assistant rose to the top of the free software download charts on Apple's iPhone store on Monday. The notion that the Chinese firm has caught up to the leading American businesses in generative AI at a fraction of the cost is one of the things that worries some watchers of the U.S. tech sector.

- If accurate, that raises doubts about the enormous sums of money that American tech companies claim they intend to spend on the computer chips and data centers required to support future developments in AI.

- However, misunderstandings and exaggeration over DeepSeek's technological innovations also caused uncertainty.

- Several stock experts, like Stacy Rasgon of Bernstein, who tracks the semiconductor business, described Wall Street's response as exaggerated, saying, "The models they built are fantastic, but they aren't miracles either."

- According to Rasgon, "they're not using any innovations that are unknown or secret or anything like that." "Everyone is experimenting with these things."

Read Also: What are the main reasons behind the recent stock market decline?

What is DeepSeek?

Later that year, DeepSeek, a Chinese business based in Hangzhou, unveiled its first AI big language model. Its CEO, Liang Wenfeng, was a co-founder of High-Flyer, a leading hedge fund in China that specializes in AI-driven quantitative trading. According to a post that summer on the Chinese social networking site WeChat, the fund had accumulated a cluster of 10,000 of California-based Nvidia's high-performance A100 graphics processor chips by 2022, which are needed to create and operate AI systems. Soon later, the United States banned certain chips from being sold to China.

According to DeepSeek, its latest models were constructed using Nvidia's less powerful H800 processors, which are legal in China. This suggests that advanced AI research may not require the most expensive technology.

After releasing a new AI model last month that it claimed was comparable to models from American companies like ChatGPT maker OpenAI and was more economical in its use of pricey Nvidia chips to train the system on massive amounts of data, DeepSeek started to garner more attention in the AI industry. When the chatbot first surfaced on the Google and Apple app stores earlier this year, it became more widely available.

However, the hysteria that ensued was triggered by a follow-up study article that was released last Friday, the same day that President Donald Trump took office. That research discussed another DeepSeek AI model, R1, which was substantially less expensive than an OpenAI model of the same name, o1, and demonstrated sophisticated "reasoning" abilities, such as the capacity to reconsider how it approached a mathematical issue.

Must Read: What is the goal of the stock market prediction?

What makes DeepSeek different?

Although the business hasn't revealed the data it used for training, DeepSeek's models are "open source," which means that important components are freely accessible and modifiable by anybody. This sets it apart from rivals like OpenAI.

The feature of DeepSeek's R1 model that has garnered the most praise, however, is what Nvidia refers to as a "perfect example of Test Time Scaling"—the process by which AI models successfully demonstrate their line of reasoning and then utilize it for more training without requiring them to be fed new data sources.

"Basically, it's just thinking aloud," Rand Corp. researcher Lennart Heim said.

The same is true of OpenAI's reasoning models, which begin with o1, and Heim stated that other American rivals like Anthropic and Google probably possess comparable but unreleased capabilities.

On the other hand, "this is the first time we've seen a Chinese company close that quickly." That's probably why so many people are interested in it," Heim said. I had thought that OpenAI was the industry leader and that no one could overtake it. It turns out that this isn't entirely true.

FAQs

What does DeepSeek do?

DeepSeek self-censors on subjects considered sensitive in China, much as all other Chinese AI models. It sidesteps concerns concerning the Tiananmen Square demonstrations of 1989 or sensitive geopolitical issues like the potential for a Chinese invasion of Taiwan.

What company makes DeepSeek?

Liang Wenfeng, a seasoned businessman who also manages the hedge fund High-Flyer, created the Hangzhou-based DeepSeek in late 2023. Although not well-known outside of China, Liang has a long history of fusing investment with emerging technology.

What does the stock market's depth mean?

The capacity of the market to support a significantly bigger order without affecting the market price of the security is known as market depth. It also refers to the quantity of a company's shares that may be bought without significantly raising the value of the specific stock.

Why does DeepSeek impact Nvidia?

Investor trust in Nvidia's moat and long-term direction has been severely damaged by DeepSeek's success in creating competitive AI models using lower-capability Nvidia processors, a feat accomplished at a fraction of the expenditures invested by U.S. tech titans.

How to see buyers and sellers in the stock market?

Market depth refers to the quantity of buyers and sellers of a stock at a specific price. In addition to the trading terminal, you may access NSE & BSE, moneycontrol, and trade view. Google search "stock" followed by "market depth." Usually, I view it via the NSE website or my trading terminal.

What makes DeepSeek so effective?

DeepSeek uses pure reinforcement learning, which enables models to learn by trial and error and self-improve through algorithmic incentives, in contrast to conventional techniques that mostly rely on supervised fine-tuning. This method has been very successful in enhancing DeepSeek-R1's capacity for reasoning.

No comments